22.04.2024

Евгений Лебедев

385

Exchange rate fluctuations are a natural consequence of the floating exchange rate system that is the norm for most large economies. Many technical and fundamental factors influence the exchange rate of one currency against another. These include the supply and demand for both currencies, economic indicators, inflation prospects, interest rate differentials, capital flows, and technical support and resistance levels. These factors and the value of currencies tend to be in a state of perpetual volatility. The price of a currency is supposed to be largely determined by the underlying economy, but significant currency movements in the Forex market can dictate the fate of the economy.

Currency effects have far-reaching consequences

Currency fluctuations have far-reaching effects on the economy, but most people don't pay much attention to currency exchange rates because their business transactions are conducted in their home currency. For the average consumer, exchange rates only become important for certain activities such as traveling, buying goods, or transferring funds abroad.

Most people believe that a strong national currency is a good thing because it allows them to travel or buy imported goods more cheaply. In fact, a currency that is too strong can have a significant impact on a country's economy in the long run as industries become less competitive and thousands of jobs are lost.

The value of a nation's currency in the foreign exchange (Forex) market is an important tool in the central bank's arsenal and a key factor in determining monetary policy. Directly or indirectly, exchange rates affect a number of economic variables. They can play a role in the interest rate you pay on your mortgage, the yield on your investment portfolio, the prices at your local supermarket and even your job prospects.

The impact of currency on the economy

The price of a currency has a direct impact on the following aspects of the economy:

Trade in goods: this refers to a country's international trade, exports and imports. A weak currency encourages exports and makes imports more expensive, reducing a country's trade deficit (or increasing its surplus) over time.

Conversely, a strong currency can make exports less competitive and imports cheaper, which can increase the trade deficit and eventually weaken the currency in a self-regulating mechanism. But before this happens, export-intensive industries can be destroyed by too strong a currency.

Economic Growth

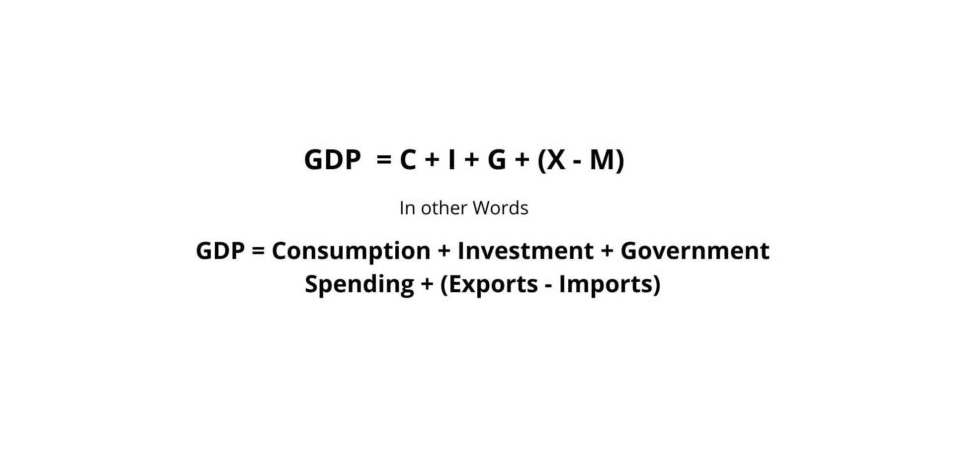

The basic formula for GDP is C + I + G + (X - M)

- C = consumption or consumer spending, the most important component of the economy;

- I = capital investment by businesses and households;

- G = government spending;

- (X - M) is exports minus imports, or net exports.

From this equation, it is clear that a country's GDP will be high if the value of net exports is high. As mentioned earlier, net exports are inversely related to the strength of a nation's currency.

Capital flows: foreign capital seeks countries with strong governments, dynamic economies and stable currencies. To attract capital from foreign investors, a country needs a relatively stable currency. Otherwise, the prospect of foreign exchange losses due to currency depreciation may discourage foreign investors.

Inflation: currency depreciation can lead to "imported" inflation in countries that are large importers. A sudden depreciation of the local currency could lead to higher prices for imported goods.

Interest rates: as discussed above, the level of the exchange rate is a key factor for most central banks. For example, the former governor of the Bank of Canada, Mark Carney, stated in a speech in September 2012 that the bank had taken the Canadian dollar exchange rate into account in its monetary policy. The central bank decided to pursue an exceptionally loose monetary policy because of the continuous appreciation of the Canadian dollar.

Examples of the global impact of currencies

The global foreign exchange (Forex) market is the largest financial market, with a daily trading volume of over 5 trillion, far surpassing all other markets, including stocks, bonds, and commodities. Despite such huge trading volumes, currency prices change very little most of the time. However, there are times when currencies change dramatically and then the effects can be felt around the world.

Three examples

The Asian crisis of 1997-98

A great example of how unfavorable currency fluctuations disrupt economies. The Asian crisis began with the devaluation of the Thai baht in July 1997. The devaluation followed an intense speculative attack on the baht, which forced Thailand's central bank to abandon its peg to the U.S. dollar and let its currency float. This triggered a financial meltdown that spread like wildfire to neighboring countries Indonesia, Malaysia, South Korea and Hong Kong. The currency contagion led to a severe recession in these countries, bankruptcies increased and stock markets plummeted.

Yen fluctuations from 2008 to mid-2013

The Japanese yen was one of the most volatile currencies over a five-year period. In August 2008, as global credit tightened, the yen, which had been the preferred currency for carry trades thanks to Japan's near-zero interest rate policy, began to appreciate sharply as panicked investors bought the currency en masse to repay yen-denominated loans. In five months, the yen's exchange rate against the U.S. dollar rose more than 25%. In 2013, Prime Minister Abe's plans to boost monetary and fiscal policy, dubbed "Abenomics," caused the yen to fall 16% in the first five months of the year.

Euro fears (2010-12)

investors feared that heavily indebted countries such as Greece, Portugal, Spain and Italy would be excluded from the European Union, leading to its breakup. In seven months, the euro fell 20%, from a level of 1.51 in December 2009 to around 1.19 in June 2010.

Benefits for investors

Here are some recommendations on how to capitalize on Forex movements:

Invest abroad: invest in countries with strong economies when your local currency is low. For example, in the US, when the dollar is weak, your investments will strengthen due to the currency's appreciation.

Invest in multinational corporations: The U.S. is home to the largest number of multinational companies, many of which derive much of their revenues and profits from foreign countries. U.S. multinationals' profits are boosted by a weak dollar, which should lead to higher stock prices when the dollar is weak.

Avoid borrowing in currencies with low interest rates: this has certainly not been an issue since 2008, as U.S. interest rates are at their lowest levels in years. At this point, investors tempted to borrow in foreign currencies with lower interest rates should be reminded of the fate of those who had to pay back the yen they borrowed in 2008.

Hedging currency risk: unfavorable currency fluctuations can have a big impact on your finances, especially if you are heavily involved in Forex. There are many tools for hedging currency risk, including currency futures, currency options and exchange-traded funds (ETFs) such as the Euro Money Fund (FXE) and CurrencyShares Japanese Yen Trust (FXY). If your currency risk is significant, you should consider hedging.

Changes in currency exchange rates can have a large impact not only on the national economy but also on the global economy. Investors can use these fluctuations to their advantage by investing overseas or in U.S. multinational corporations when the U.S. dollar is weak. Since currency fluctuations can involve significant risk, it is best not to take excessive risk in Forex and hedge that risk with the many hedging tools available.