17.04.2024

Евгений Лебедев

418

You have probably heard of the term "lots" which is often used in Forex circles, this information is essential for any Forex trader. Trading without knowledge of this terminology is possible, but all those who strive for professionalism and increase their income when trading Forex never stop in the pursuit of improving their knowledge and skills, so you have a good opportunity to understand.

What is a pip and lot

The most common currency fluctuation is a pip. If the EUR/USD rate rises from 1.2250 to 1.2251, it increases by one pip. A pip is the last decimal in a quote. It is with a pip that you measure your profit or loss. Since each currency has a different value, you need to calculate the pip value for a particular currency.

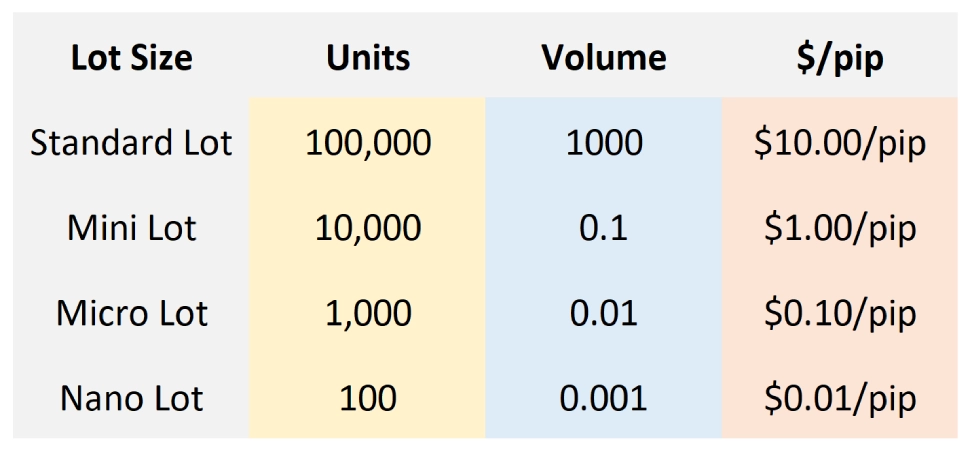

The standard lot size is 100,000 units. There are also lots where the minimum size is 10,000 units. As you already know, currency fluctuations are measured in pips, which are the smallest increments of a currency. To profit from these tiny units, you need to trade currencies in larger quantities so that the profit (or loss) grows.

How to calculate profits and losses

Let's look at how you would calculate your profit or loss. Let's buy US dollars and sell Swiss francs. The exchange rate is fixed at 1.4525/1.4530. Buying dollars, you will work at 1.4530 - the rate at which traders are willing to sell.

So, you buy 1 standard lot (100,000 units) at 1.4530. A few hours later, the quote rises to 1.4550 and you decide to close the trade. The new USD/CHF quote is 1.4550/1.4555. Since you are closing the trade, and you originally "bought" to enter the trade, you must now sell at 1.4550 to close the trade. This is the price at which traders are now willing to buy. The difference between 1.4530 and 1.4550 is .0020 or 20 pips.

Remember, when you enter or exit a trade, you are subject to the bid-ask spread. When you buy a currency, you are sticking to the bid price and when you sell, you are sticking to the ask price. So when you buy a currency, you pay the spread, but not when you exit. And when you sell a currency, you don't pay the spread on entry, but you do when you close the trade.

What is leverage

You might be wondering how a small investor like you can trade such huge amounts of money. Imagine that your bank has lent you $100,000 to trade, asking for just $1000 in return as a deposit - a deposit that you don't have to keep, of course.

Is it too good to be true? Well, that's the way Forex trading works: using leverage. The amount of leverage depends on your broker and the risks you are willing to take. Generally, the account margin or initial margin is set in proportion to your deposit. Once you have deposited money into your account, you can trade directly using leverage. If the leverage is 100:1 (i.e. 1% of the required position) and you want to trade a $100,000 position, you will have to set aside $1,000, which is equivalent to the "margin".

If you can start with $5,000, you can trade up to $500,000 in Forex. The minimum margin for each lot varies from broker to broker. In the example above, the broker requires a margin of one percent. This means that for every $100,000 invested in the trade, the broker requires $1,000 as an initial payment for the position.

At first glance, all of this may seem fancy and complicated, but if you take the time to figure it out, you'll be surprised over time how much of an impact it will have on your trading skill. And of course it will affect your income as well, because we gain knowledge so that we can monetize it later.