02.05.2024

Евгений Лебедев

360

The foreign exchange market, also known as Forex, presents a vast and potentially lucrative landscape for investors. However, navigating this landscape requires caution, as unscrupulous actors often prey on unsuspecting individuals. In this review, we delve into OKX Foreign Exchange Trading Company (OKX) and unveil a series of red flags that raise serious concerns about its legitimacy.

Aesthetics Don't Inspire Confidence

First impressions matter, and in the realm of online finance, a platform's presentation speaks volumes. Upon entering the OKX website, visitors are greeted with an underwhelming visual experience. The animation on the site appears clunky and malfunctioning, creating an unprofessional first impression. Furthermore, glaring absences mar the user interface, with empty squares standing in for what should presumably be icons. These shortcomings raise questions about the professionalism and resources invested in the platform, potentially indicating a lack of commitment or resources.

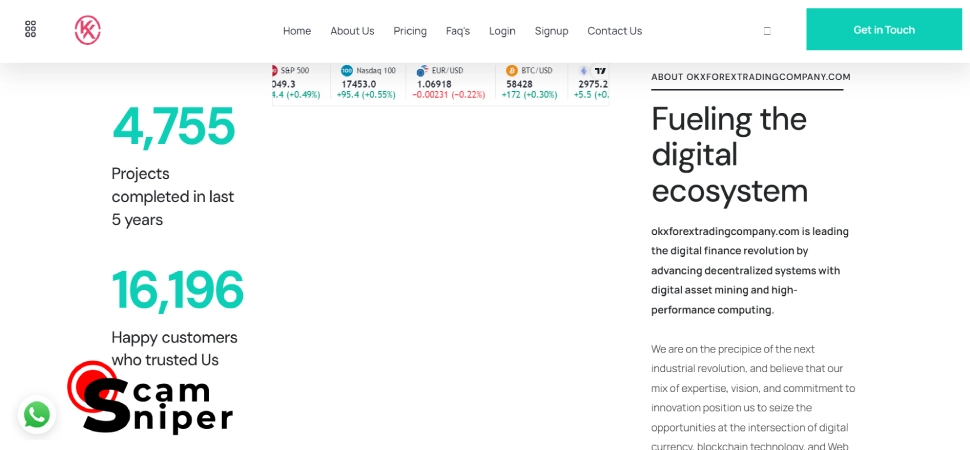

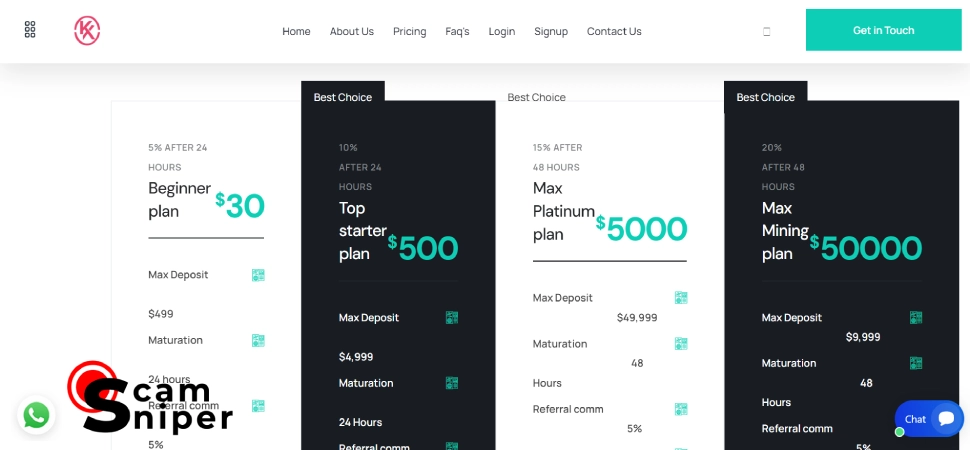

Suspicious Vagueness

For any potential investor, understanding a trading platform's offerings and functionalities is paramount. Unfortunately, OKX's website fails to deliver on this crucial aspect. Critical information regarding account types, minimum deposits, spreads, and available currency pairs is frustratingly absent. A legitimate trading platform should strive for transparency, clearly outlining the financial instruments it offers and the associated costs. The conspicuous lack of such details on the OKX website fosters an atmosphere of suspicion and hinders informed decision-making.

Unrealistic Claims and Missing Regulatory Information

Beyond the aforementioned issues, the content on the OKX website further undermines its credibility. The language employed is rife with hyperbolic claims, promising investors outsized returns with minimal effort. Financial markets are inherently complex, and substantial returns are never guaranteed. Legitimate trading platforms focus on education and risk management, not unrealistic promises of overnight riches.

Perhaps the most concerning omission on the OKX website is the complete absence of any regulatory information. Financial regulatory bodies exist to protect investors from fraud and malpractice. Reputable trading platforms prominently display their regulatory licenses, providing peace of mind to their clientele. The lack of such information on the OKX website is a glaring red flag, suggesting the platform might be operating outside the bounds of financial regulations.

Limited Contact Options and Unprofessional Communication

The professionalism of a platform's communication reflects its overall approach to business. Should you choose to contact OKX via email, be wary of unprofessional or generic responses, as these could be further indicators of a less-than-reputable operation.

Uncovering Online Reviews Paints a Bleak Picture

While the shortcomings exposed on the OKX website are concerning, a deeper dive into independent online reviews paints an even bleaker picture. Several user testimonials detail negative experiences with OKX, including difficulties withdrawing funds and unresponsive customer support. While online reviews should always be considered with a degree of caution, the sheer volume of negative sentiment towards OKX warrants serious consideration.

Red Flags

- Unprofessional website design with malfunctioning animation and missing icons.

- Lack of transparency regarding account types, minimum deposits, spreads, and available currency pairs.

- Unrealistic claims of outsized returns with minimal effort.

- Absence of regulatory information.

- Limited contact options with only a single email address for support.

- Negative online reviews detailing difficulties withdrawing funds and unresponsive customer support.

In Conclusion

Given the multitude of red flags identified in this review, we strongly advise against investing with OKX Foreign Exchange Trading Company. The unprofessional website design, lack of transparency, unrealistic claims, and absence of regulatory information are all cause for serious concern. Furthermore, the negative online reviews paint a troubling picture of user experiences. The foreign exchange market offers a wealth of legitimate trading platforms. Do your due diligence, prioritize platforms with a demonstrably professional approach, and avoid potentially risky ventures like OKX Foreign Exchange Trading Company.

Recommendations for Scammed Traders

If you suspect you've fallen victim to a trading scam, here are some crucial steps to take:

- Stop Investing Immediately. Cut off all contact with the fraudulent platform. Don't make any further deposits, and attempt to withdraw any remaining funds in your account. However, be aware that scammers often make withdrawal difficult or impossible.

- Gather Evidence. Collect and document all evidence related to your interaction with the platform. This includes screenshots of the website, emails, chat logs, and any deposit or withdrawal transactions.

- Report the Scam. File a complaint with the relevant financial regulatory bodies in your jurisdiction. You can find a list of regulatory bodies by searching online. Additionally, report the scam to the Federal Trade Commission (FTC) in the United States or your local consumer protection agency.

- Consider Legal Action. Depending on the severity of the scam and the amount of money lost, consulting with a lawyer might be advisable. They can advise you on your legal options for potentially recovering your losses.

- Seek Emotional Support. Being scammed can be a deeply frustrating and emotionally taxing experience. Don't hesitate to reach out to friends, family, or a therapist for support.

Remember, investing involves inherent risks. Always conduct thorough research before entrusting your hard-earned money to any trading platform.